Photo by Kelly Sikkema on Unsplash

The tax filing deadline is just days away so I thought this was a good time to touch on one of the most overlooked tools in saving taxes on your hard earned money. My news feed is full of tips and articles on how to save on your taxes, yet this one simple tool is often overlooked. I’m going to cover:

- What an FSA is

- Who they are best for

- How to use your FSA

- What can you pay for with your FSA

- How they help employers

- How much you can save on your taxes with a sample family tax analysis

A Flexible Spending Account(FSA), falls under IRS Section 125 which allows employees to convert some of there taxable income into non-taxable benefits. The most common FSA types are the medical and dependent care. The maximum annual election for 2019 is $2,700 for medical, and $5,000 for dependent care.

Please stay with me and don’t overlook this great tax savings strategy.

Setting The Stage of Taxes, and Medical + Dependent Care Expenses

Before I go into the workings of the Section 125 plans, it will be helpful to show how most people handle their expenses without a Flexible Spending Account.

Medical Expense Deduction

In 2019, the IRS allows you to deduct medical expenses that exceed 7.5% of your income. This means that if you have $10,000 of expenses, you can deduct $2,500 of those expenses.

To take the medical expense deduction, you have to itemize your tax deductions. This means that totaling up your deductions will exceed taking the standard deduction of $12,200 for singles and $24,400 married filing jointly.

With the much higher standard deduction, and other changes to the tax laws, it will be much harder for families to exceed that amount in 2019 and going forward.

What does that mean to you? Expect to be taking the standard deduction and you won’t be able to deduct your medical expenses.

Dependent Care Expenses

Photo by Brytny.com on Unsplash

There is a provision in the tax law that allows you to deduct certain dependent care expenses.

The law allows for up to a 35% tax credit on the first $3,000 of daycare expenses for one child, and up to $6,000 for one or more children. The key phrase is “up to”. The percentage is based on a sliding scale and is reduced to 20% once your income exceeds $43,000.

So if you are paying $800 a month for your child’s daycare, and your earnings are above $43,000, you will get a credit of:

20% of the first $3,000, which is $600.

If you had two children in daycare and you paid $1600 a month as an example, you will get a credit of:

20% of the first $6,000 or $1200.

Where the medical expenses are a deduction, the child care situation is a tax credit. A deduction lowers your taxable income, whereas a credit reduces the taxes you will owe, dollar for dollar.

What is an FSA?

Now that I’ve set a little groundwork for how expenses work on your taxes, I will go over the actual FSA. FSA stands for Flexible Spending Account and it’s a tax favored account that is set up through your employer.

The FSA allows you to defer some of your earnings into this special account that is to be used for qualified medical expenses or for dependent care. There are some other options as well, but these are the most common uses.

How Much Can I Contribute?

The IRS allows you to defer up to $2700 in 2019 for a medical FSA and up to $5,000 per year for a dependent care FSA.

When you elect the coverage, your employer will split up the amounts over your annual paychecks and deposit the money into your account. A third party administrator will handle everything and will set up the account along with a debit card and checkbook.

As an example, you defer up to $1200 a year, your employer would deduct $100 a month from your paycheck to be used for medical expenses.

What Can I Use The Money For?

The medical FSA must be used for qualified medical expenses. This includes things like dental care, vision, medical etc.. You can look up the items line by line in IRS publication 502.

For the dependent care FSA(DCA), there are a few extra rules involved. In order to qualify, the care must be necessary to allow you and, if married, your spouse to work and earn an income or attend school full time.

The eligible expenses are:

- Child Care

- Adult Care

- In-home dependent care

- Before and After School Care

- Nursery School

What If I Don’t Use All Of The Money?

This is one of the gotchas about the FSA plans that people don’t like. Traditionally with these setups, they are use it or lose it. Meaning, if the money isn’t spent, it gets forfeited to your employer.

Thankfully, most plans now will have special rules that will allow you to have an additional grace period to use the money after the calendar year ends, OR the ability to rollover up to $500 into the next year.

The grace period provides up to 2 1/2 more months to use whatever medical FSA funds you have left. Unfortunately, there is no grace period or rollover for the dependent care account.

How FSA’s Help Employers

For you to participate in an FSA, your employer has to support this and set the plan up. For them, it means extra administration and there is also a cost involved. From what I’ve seen, it can be a few hundred dollars a year or thousands depending on how many employees are in the company.

The biggest benefit for employers is that they aren’t paying FICA on any of your contributions. This means they save 7.65% on every dollar you defer.

For every thousand dollars that goes in, they save $76.50. Not too shabby.

In addition to saving on FICA, the use it or lose it rules, will benefit them. If an employee has $1000 left in their account at the end of the year, they can roll over $500, but they forfeit the other $500 to the employer. This money can be used to help pay for administration or other losses. Which leads me to my next point…

How FSA’s Hurt Employers

Unfortunately, the benefits to employers aren’t so cut and dry. Yes, they save on FICA, and can recapture unused funds, but they also have some risks, especially when participation is low.

With an FSA, the money you defer is 100% available to you on the first day of the year. If your family defers $1500, that whole sum is available on day 1 even if you haven’t paid a penny from your salary.

The money comes from the employer.. The employer is obligated to have the money available to each employee so this can be big risk to them if cash flow isn’t great. Picture a small employer with 10 employees that have chosen to defer $2000 each. That’s $20,000 the employer could potentially have to front right away.

Not only that, if you use the money and then leave during the year, they have no recourse for getting the money back. Its a loss for them. That is why they have the recapture rules for unused funds.

It’s not all bad though, if the plan runs well and participation is good, the employers stand to save over the long run.

Only the medical FSA’s have the upfront funding rule. The dependent care FSA’s do not.

FSA Tax Savings!

Finally, the big benefit of the FSA. Tax savings!!! Its not huge, but it adds up. It reminds me of the saying, “little hinges, swing big doors” by W.Clement Stone. Keep doing some of these little things in your financial life, and they can make a huge difference.

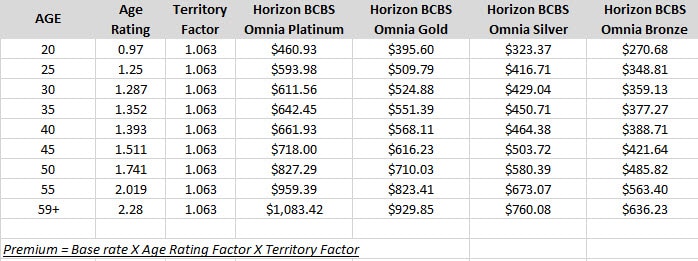

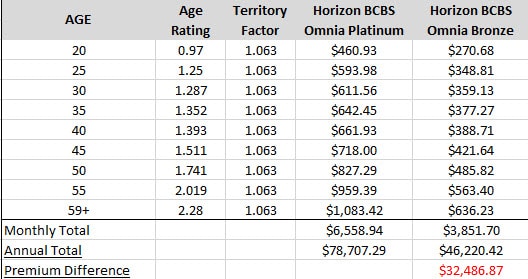

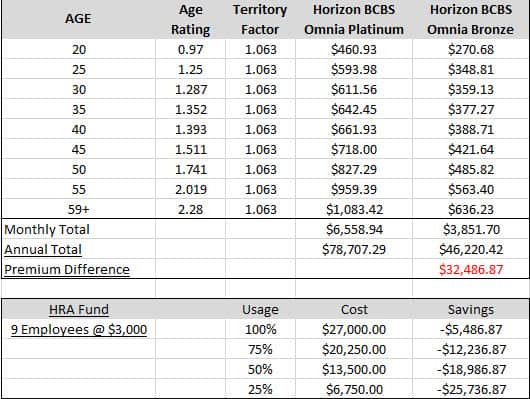

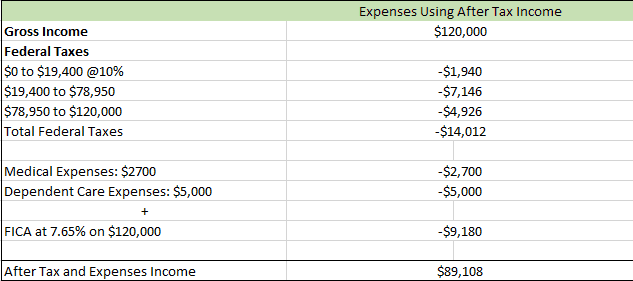

In the chart below, I have some sample calculations for a family that earns a gross income of $120,000. They have medical expenses of $2700 and dependent care expenses of $5,000.

After taking out federal taxes and the costs of the medical and dependent care, their net income is $89,108.

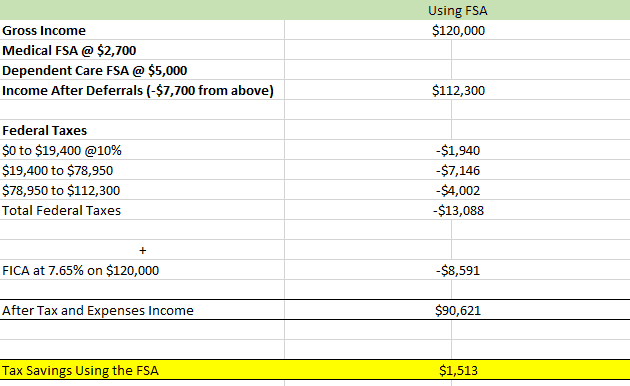

In the second spreadsheet, I have the same exact scenario, but in this case the family used the medical FSA and dependent care FSA offered by their employer.

In this case, their income is $90,621 after the same exact expenses. That is a tax savings of $1513 just for deferring into the tax advantaged accounts.

Finance bloggers talk about the latte factor and saving $5 a day, and make no mention of this tool. We are working with saving over $100 a month, with this one simple switch. It will pay for your coffee habit and then some.

Related Questions

Are Flexible Spending Accounts worth it? Yes, as long as you have somewhat predictable medical expenses each year, and/or dependent care expenses. You can expect to save around 20- 25% in taxes on every dollar you put in. As your income rises, your savings increase.

Is FSA money available immediately? Yes, on the first day of the plan year or after your new employee wait period, you can access 100% of the money. Dependent Care FSA’s are not available immediately. As the money is withdrawn from your checks, it then becomes available.