Hi everyone, just a short video comparing the networks of Horizon BCBS and Amerihealth.

Video Transcription via Rev.com

Mike: Hi everyone, it’s Mike for NewJerseyinsuranceplans.com. Today I’m going to go over the network differences between Horizon Blue Cross, and Amerihealth. Now, the reason I’m going over this is that, a lot of the plans within our Horizon Blue Cross and Amerihealth, they sound very similar. For example, Amerihealth has a plan called their Advantage plan. Horizon has a plan called their Advantage plan.

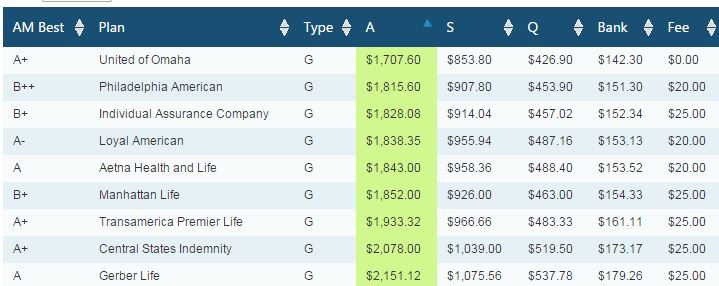

As far as our network is concerned, they are very different plans. So today I wanna go over how the different plans work and also compare that their Omni plans within Horizon. And the first screen you’re looking at here is something I will make available. But it’s just a spreadsheet I made, and these are the individual plans in New Jersey for 2018.

So, I combined all the rates into one spreadsheet, and then down at the bottom here I have some links where you can download the plan guides, and the rate sheets and applications if you need them. Now, we’re just gonna look at everything in one spot, and you can scroll over and pull your age and the price for whatever plan you’re looking at.

So, the first carrier I’ll go over will be Amerihealth. And within the Amerihealth plans, you’ll have access to a few different networks. So, the first one and what I call their normal network is called, Regional Preferred. Now, with the Regional Preferred network you can see you have all of New Jersey, you’ll have part of Delaware, and part of the Philadelphia region. So this would be your teaching hospitals in the Philadelphia region.

So, Jefferson Penn, Chop, you know all the big ones that you would tend to go to in the Philadelphia region. Now, Amerihealth also sells some lesser priced plans that are part of their local value network. So the local value network is about 82% of their New Jersey based hospitals. As you can see how it’s highlighted here. You can only go to New Jersey.

So that’s something pretty big to keep in mind because when you’re looking at the prices and comparing them to Horizon, it’s always not apples and apples. If the price is close, you have to make sure you’re not looking at a local value plan and comparing it to one of the plans with Horizon, where they may have the full network. So as we go down the list, we can continue down to their Amerihealth Advantage series, or their tier one Advantage series.

With Amerihealth Advantage, you have to live in one of these Highland counties, and you can receive a lower premium for your plan. If you purchase one of their tier one Advantage plans, you can see here that it’s still all of New Jersey, and you can pay a lower co-pay if you use what they consider a Tier one provider. So, you can go on their network and look up to see where your provider falls and if they’re considered Tier one and pay a low co-pay. So it’s not so bad.

Now if we look at the Horizon Blue Cross plans, you’ll notice some similar names down. Now these are the small group networks, they will work exactly the same as individual. So I’m just going to show you here. So, within Horizon Blue Cross you have what they call their Omni network, and you have what they call their Advantage network.

So this is one of the guides I also make available on that link you saw here. So, for 2018, these are the Advantage series plans within Horizon Blue Cross, and they have their Advantage Silver, which is what they’ve had for years. They have their Advantage Bronze, which is new for this year, and Advantage Essentials. Now, unlike Amerihealth, Horizon Blue Cross’s advantage plans have access to their full network.

So you can go anywhere in New Jersey that’s in network, anywhere in the Philadelphia region that’s in network, New York, parts of Delaware. It’s their full network. You don’t need a referral for these plans. You don’t have to worry about anything being Tier one or Tier two. You just use the network. Very simple. Now they … A few years ago, they came out with what they call their Omni plans.

Now with their Omni plans, the network is identical in every way. So, if a doctor takes their Advantage plan, they will take Omni. What will change though, is the tier that they fall under. So, similar to Amerihealth, where they have both Tier one and Tier two, these Omni plans also have Tier one and Tier two. So you just have to look up your providers and see what tier they fall into. And you’re co-pay or co-insurance will depend, depending on the tier they refer into.

So again, just a big thing to keep in mind is when comparing rates … And I’ll go back to the rate sheet here. When you compare say, their Omni bronze HSA, that’s the Horizon plan, you can compare it to the Amerihealth plan. The prices aren’t that much different between these two, but the networks are very different. So, on this one you can use Horizon’s full network. This one here, New Jersey only and, it’s going to use the tier system.

So that’s it for today. Just wanted to go … A quick review of the 2018 networks with Horizon Blue Cross and Amerihealth, ’cause I know it can be very confusing. If you have any questions, please contact me anytime at [email protected], and have a great day. Thanks. Bye-bye.